Diluted earnings per share formula

The diluted share count differs from the basic share count. Diluted Earnings Per Share Formula.

What Is Dilutive Vs Antidilutive For Eps Universal Cpa Review

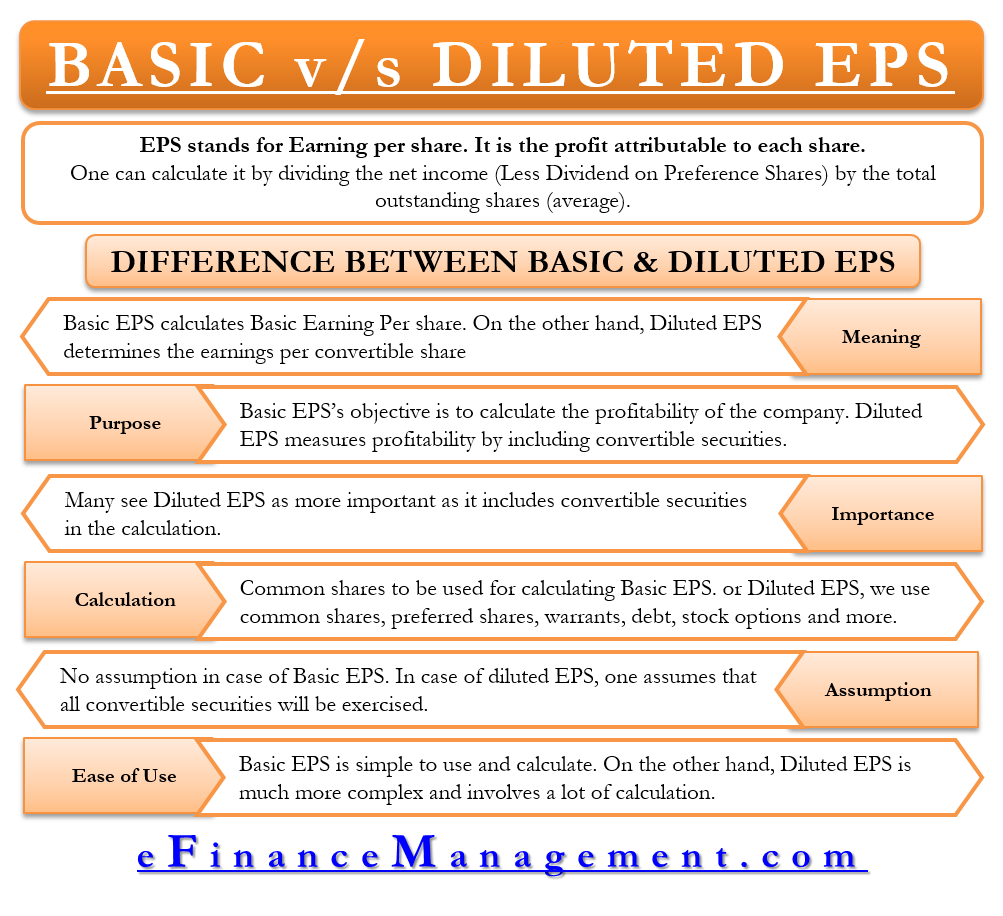

Earnings per share EPS and diluted EPS are profitability measures used in the fundamental analysis of companies.

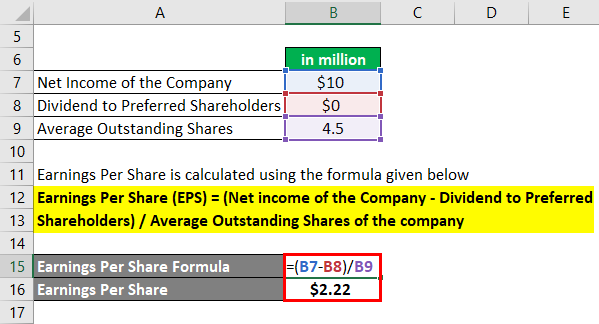

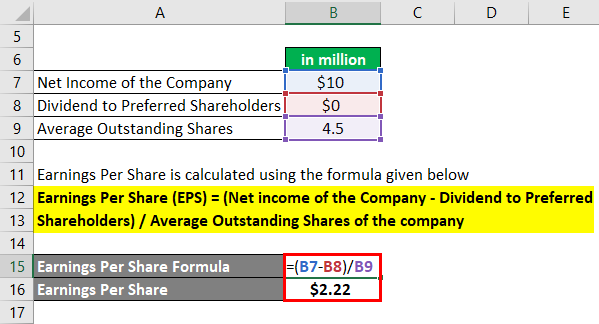

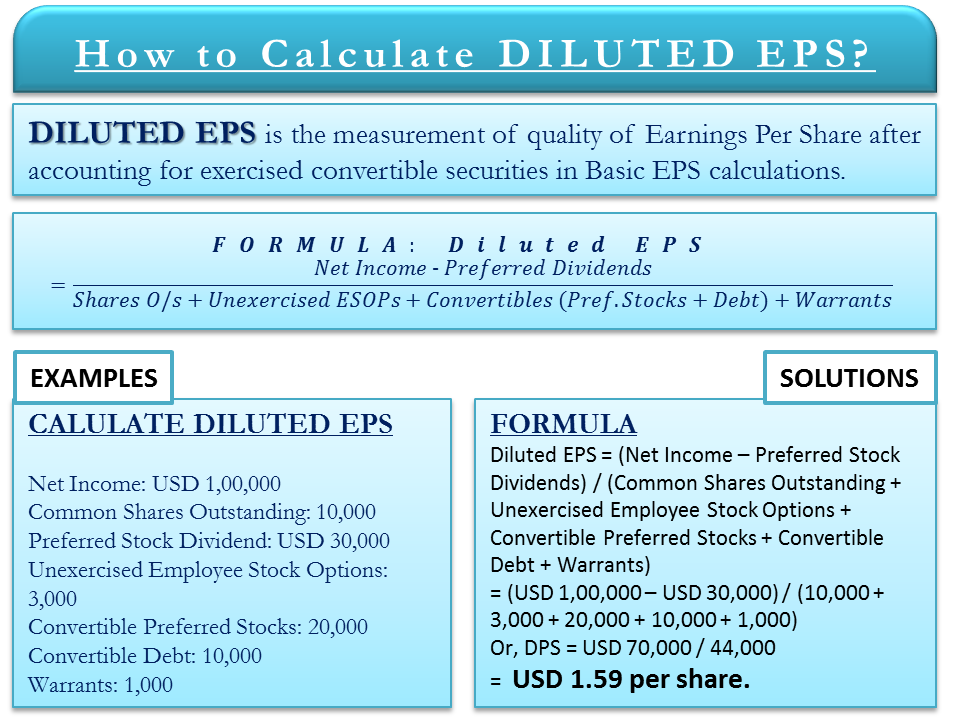

. Diluted Earnings Per Share is calculated using the formula given below. Fully diluted earnings per share assumes that any security that can be converted into common stock is converted and dilution increases. You can calculate EPS using the formula given below.

There are two different types of earnings per share. Then you divide the 95 million by the 100 million shares outstanding. EPS for a company with preferred and.

The EPS would be calculated as 095 per share. The diluted earnings per share formula is the same. Here is an illustration of that calculation.

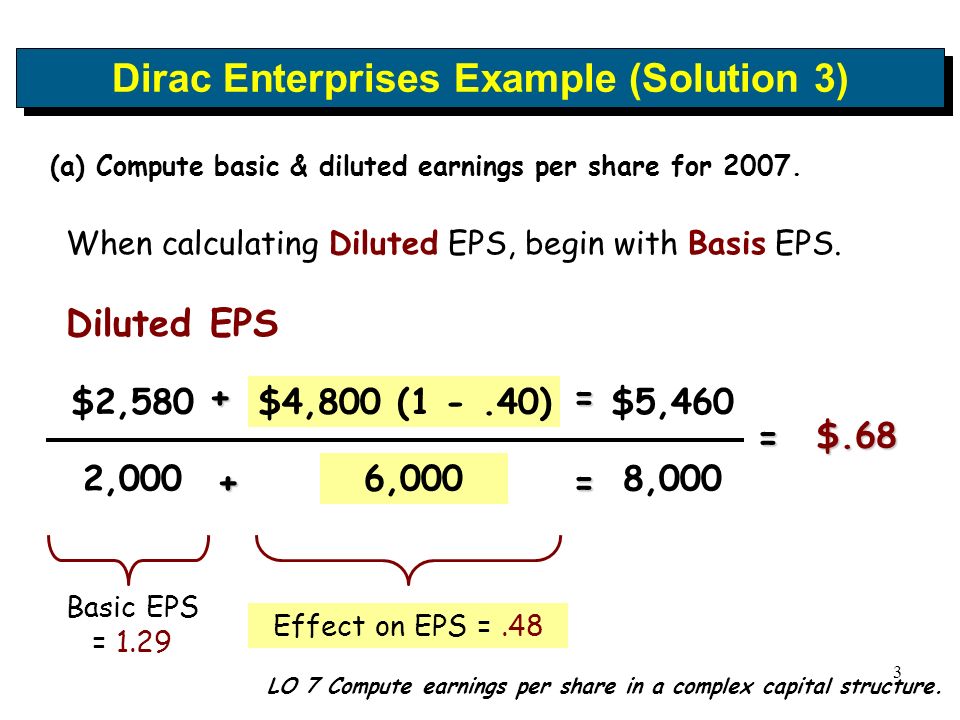

Lowrys controller wants to calculate the amount of diluted earnings per. Lowrys basic earnings per share is 200000 5000000 common shares or 004 per share. EPS takes into account a companys common shares.

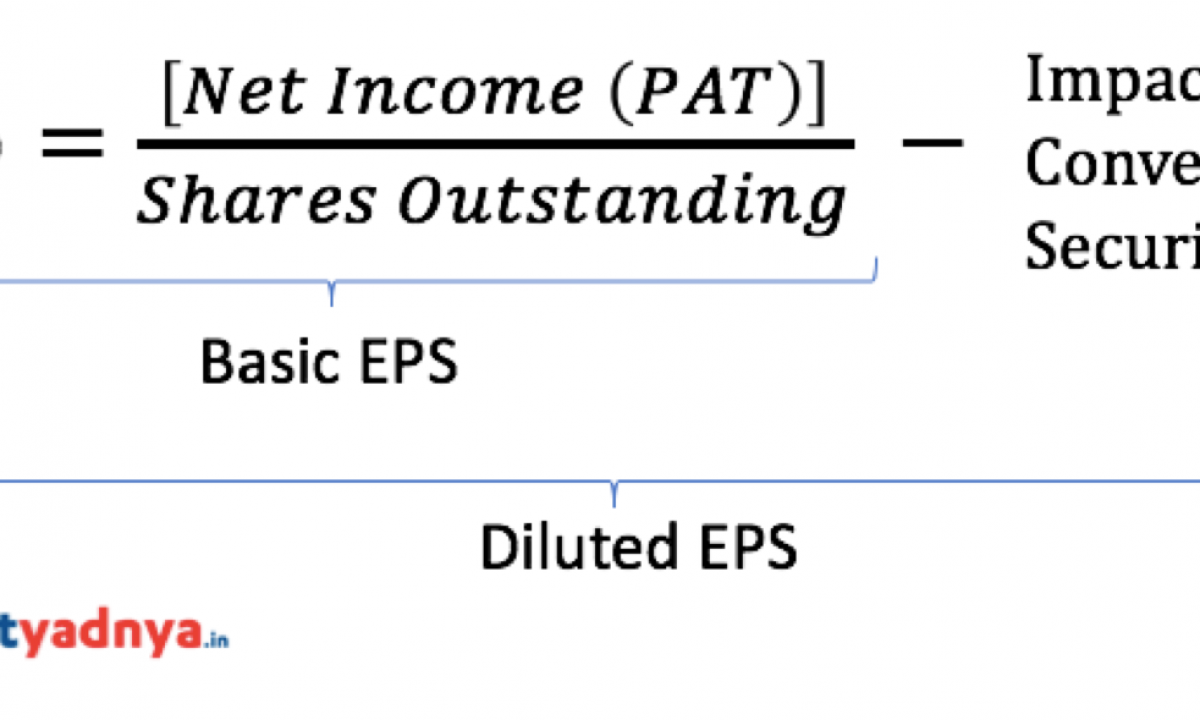

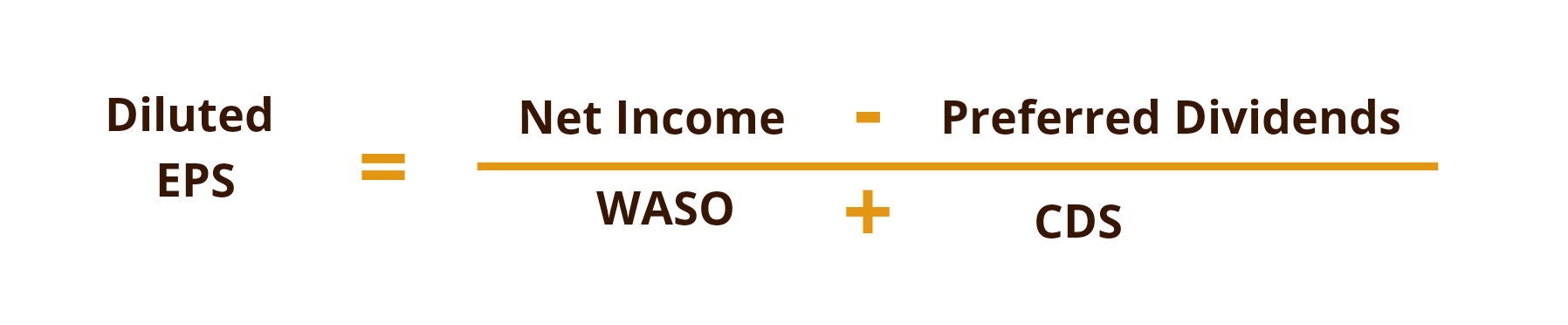

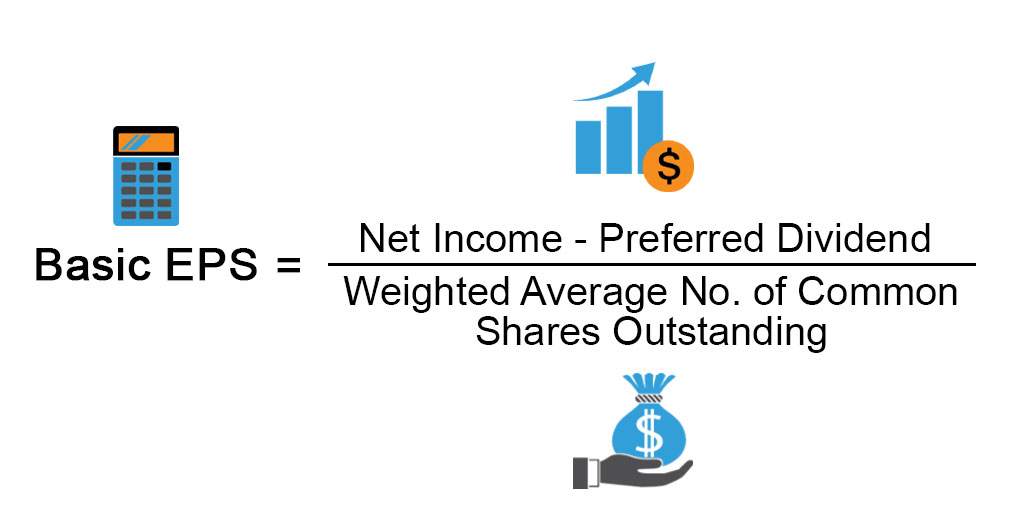

Calculating Diluted Earnings per Share EPS Formula Calculating diluted earnings per share is a way to account for all shares a company might issue. Earnings per share EPS is the portion of a companys profit allocated to each outstanding share of common stock. Net profit for the period divided by the diluted share count.

Where DEPS is the diluted earnings per. Diluted Earnings Per Share Formula. Thus the formula for the average shares portion of the diluted earnings per share for this example would be 75100 25120 which would.

The following equation is used to calculate the diluted EPS of a security. By John Bromels. DEPS NI AS OI.

If the company had a. Earnings Per Share Formula Net Income Preferred DividendsWeighted Average Number of Shares Outstanding. The diluted earnings per share EPS formula is equal to net income less preferred dividends divided by the total number of diluted shares outstanding basi.

Reporting basic EPS is required because it increases the comparability of earnings between different. This represents 34s of a year and 14 of a year. Diluted EPS Net Income Paid to Non-Controlling Interest Paid out to Dilutive Securities Diluted Weighted.

Earnings Per Share Formula Eps Calculator With Examples

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

What Is Earning Per Share Eps Basic Vs Diluted Eps Yadnya Investment Academy

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-02-46d614bf6401446d8a68276252797a11.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Basic Earnings Per Share Eps Formula And Calculator Excel Template

Share Dilution Meaning Calculation Example Diluted Eps Protection

Diluted Eps Prepnuggets

Simplifying Eps

Basic Vs Diluted Eps All You Need To Know

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

Basic Eps Examples With Advantage And Limitation Of Basic Eps

How To Calculate Diluted Eps Formula Example Importance Efm

Calculating Diluted Earnings Per Share

1 Lo 7 Compute Earnings Per Share In A Complex Capital Structure Dirac Enterprises Example Solution 1 Compute Basic Diluted Earnings Per Share For Ppt Download